Hola Friends,

Thanks for the interesting feedback, both on the blog and via email. I will respond to that in some detail tomorrow. In the meanwhile let’s take a look at the root word “Phil”.

Phil means Love/Loving

A few words that originate from this root are:

Philately

Collecting of stamps and other postal matter as a hobby or an investment.

Study of postage stamps, revenue stamps, stamped envelopes, postmarks, postal cards, covers, and similar material relating to postal or fiscal history.

Etymology:

phil + atéleia: Freedom from charges (taken to mean recipient's freedom from delivery charges by virtue of the stamp which sender affixed to the letter). If you are interested atéleia can be further traced to mean a: not and telos: toll/tax

The word was coined by French stamp collector Georges Herpin (1860–65)

He came up with a Greek word that he felt most closely resembled the use of a postage stamp – to indicate that the cost of carrying the letter had already been paid by the sender and therefore the recipient did not have to pay any tax. This was an important change as earlier it was the recipient who always paid for the post.

Philtrum

The vertical groove on the surface of the upper lip, below the septum of the nose.

Etymology:

Again from philtron which also means dimple in upper lip.

Philharmonic

Fond of or devoted to music; music-loving: used esp. in the name of certain musical societies that sponsor symphony orchestras (Philharmonic Societies) and hence applied to their concerts (philharmonic concerts).

Presented by a symphony orchestra or the society sponsoring it.

Etymology:

From the Greek Phil + harmonikós musical, suitable

Philoprogenitive

Producing offspring, esp. abundantly; prolific.

Pertaining to, or characterized by love for offspring, esp. one's own.

Etymology:

From the Greek Phil + Gen (birth, race, produce)

Philtre

A potion, charm, or drug supposed to cause the person taking it to fall in love, usually with some specific person.

A magic potion for any purpose

Etymology:

The Greek philtron which literally means "to make oneself beloved”, which in turn originates from the root word Phil.

Caution: I will not be held responsible for any outcome of you guys using/misusing the Philtre. I am merely a language teacher, not….…. ;-)

On that note of caution,

Ciao

Monday, August 31, 2009

Vocab: Phil

Friday, August 28, 2009

Feedback

Dear Friends,

I have been sending the emails/posting on this Blog regularly [well almost ;-)] for more than 15 days now and thought that it was time to ask you for your opinion. I am looking for answers to a few queries so that I can fine tune the emails specifically to your requirements.

Do you think the emails have been useful? Do you find them interesting? Should I have more information per email? What are the other areas that you want me to cover?

If you have any other feedback please do not hesitate to let me know about the same. Kindly use the Comments section to let me know your opinions/ideas etc.

Looking forward to a candid feedback,

Ciao

Wednesday, August 26, 2009

Vocab: Humours

In some sessions I have also discussed how the ancient medical practitioners believed that a healthy body had a balance of four humours (essential fluids) which gave an indication of someone’s temperament. An imbalance of humours was thought to cause a change in temperament.

Those humours were blood, bile (choler), black bile, and phlegm. Each humour was associated with a season and an element (air, water, fire, and earth). While we no longer use this theory to treat people these terms continue to be used in the English language.

Choleric:

Easily irritated or angered; hot-tempered.

Etymology:

From the Greek chole (bile).

Phlegmatic:

Having a sluggish temperament; apathetic.

Calm or composed.

Etymology:

From the Greek Phlegm (inflammation, the humour phlegm supposedly as a result of heat)

Melancholic:

Gloomy; wistful.

Saddening.

Of or related to melancholia.

Etymology:

Bilious:

Extremely unpleasant.

Ill-natured; irritable.

Relating to bile.

Etymology:

From the Latin bilis (bile).

Sanguine:

Cheerfully optimistic or confident.

Having a healthy reddish color.

Blood-red.

Etymology:

From the Latin sanguis (blood).

On that bloody … oops, I meant cheerful note,

Ciao

Monday, August 24, 2009

Reading Comprehension

In 2007, Nassim Nicholas Taleb published “The Black Swan: The Impact of the Highly Improbable”. In it, Taleb expounded on the fact that most economists, and almost all bankers, are very, very dangerous. Why is that? Because they live in a fantasy world and believe that the future can be controlled by mathematical models. Bankers and economists obviously did not like this and poured scorn on Taleb. He didn’t understand, they said. [Much like my own Econometrics prof, but then that is a different story. ;-)]

A few months later the sub-prime crisis hit and Taleb had been vindicated. “It was my greatest vindication. But to me that wasn’t a black swan; it was a white swan. I knew it would happen and I said so. It was a black swan to Ben Bernanke [the chairman of the Federal Reserve]. I wouldn’t use him to drive my car. These guys are dangerous. They’re not qualified in their own field.”

Note: Black swans were discovered in Australia. Before that, any reasonable person could assume the all-swans-are-white theory was unassailable. But the sight of just one black swan detonated that theory. Every theory we have about the human world and about the future is vulnerable to the black swan, the unexpected event. We sail in fragile vessels across a raging sea of uncertainty. According to Taleb, “The world we live in is vastly different from the world we think we live in.”

That is Nassim Nicholas Taleb for you. Not exactly the paragon of modesty but he is being hailed as the greatest philosopher of our time.

The following is an extract from an essay, THE FOURTH QUADRANT: A MAP OF THE LIMITS OF STATISTICS, he wrote for “The Edge”. I want you guys to read this article and put down in the comments section your précis of the same. It is a good exercise for the RC passages in CAT

The Dangers Of Bogus Math

I start with my old crusade against "quants" (people like me who do mathematical work in finance), economists, and bank risk managers, my prime perpetrators of iatrogenic risks (the healer killing the patient). Why iatrogenic risks? Because, not only have economists been unable to prove that their models work, but no one managed to prove that the use of a model that does not work is neutral, that it does not increase blind risk taking, hence the accumulation of hidden risks.

Figure 1 My classical metaphor: A Turkey is fed for a 1000 days—every days confirms to its statistical department that the human race cares about its welfare "with increased statistical significance". On the 1001st day, the turkey has a surprise.

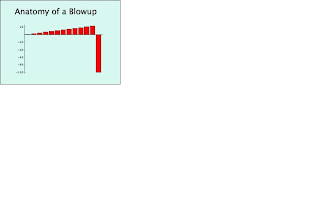

Figure 2 The graph above shows the fate of close to 1000 financial institutions (includes busts such as FNMA, Bear Stearns, Northern Rock, Lehman Brothers, etc.). The banking system (betting AGAINST rare events) just lost > 1 Trillion dollars (so far) on a single error, more than was ever earned in the history of banking. Yet bankers kept their previous bonuses and it looks like citizens have to foot the bills. And one Professor Ben Bernanke pronounced right before the blowup that we live in an era of stability and "great moderation" (he is now piloting a plane and we all are passengers on it).

Figure 3 The graph shows the daily variations a derivatives portfolio exposed to U.K. interest rates between 1988 and 2008. Close to 99% of the variations, over the span of 20 years, will be represented in 1 single day—the day the European Monetary System collapsed. As I show in the appendix, this is typical with ANY socio-economic variable (commodity prices, currencies, inflation numbers, GDP, company performance, etc. ). No known econometric statistical method can capture the probability of the event with any remotely acceptable accuracy (except, of course, in hindsight, and "on paper"). Also note that this applies to surges on electricity grids and all manner of modern-day phenomena.

Now let me tell you what worries me. Imagine that the Turkey can be the most powerful man in world economics, managing our economic fates. How? A then-Princeton economist called Ben Bernanke made a pronouncement in late 2004 about the "new moderation" in economic life: the world getting more and more stable—before becoming the Chairman of the Federal Reserve. Yet the system was getting riskier and riskier as we were turkey-style sitting on more and more barrels of dynamite—and Prof. Bernanke's predecessor the former Federal Reserve Chairman Alan Greenspan was systematically increasing the hidden risks in the system, making us all more vulnerable to blowups.

By the "narrative fallacy" the turkey economics department will always manage to state, before thanksgivings that "we are in a new era of safety", and back-it up with thorough and "rigorous" analysis. And Professor Bernanke indeed found plenty of economic explanations—what I call the narrative fallacy—with graphs, jargon, curves, the kind of facade-of-knowledge that you find in economics textbooks. (This is the find of glib, snake-oil facade of knowledge—even more dangerous because of the mathematics—that made me, before accepting the new position in NYU's engineering department, verify that there was not a single economist in the building. I have nothing against economists: you should let them entertain each others with their theories and elegant mathematics, and help keep college students inside buildings. But beware: they can be plain wrong, yet frame things in a way to make you feel stupid arguing with them. So make sure you do not give any of them risk-management responsibilities.)

The full article is present here:

http://www.edge.org/3rd_culture/taleb08/taleb08_index.html

Ciao

Gautam