In 2007, Nassim Nicholas Taleb published “The Black Swan: The Impact of the Highly Improbable”. In it, Taleb expounded on the fact that most economists, and almost all bankers, are very, very dangerous. Why is that? Because they live in a fantasy world and believe that the future can be controlled by mathematical models. Bankers and economists obviously did not like this and poured scorn on Taleb. He didn’t understand, they said. [Much like my own Econometrics prof, but then that is a different story. ;-)]

A few months later the sub-prime crisis hit and Taleb had been vindicated. “It was my greatest vindication. But to me that wasn’t a black swan; it was a white swan. I knew it would happen and I said so. It was a black swan to Ben Bernanke [the chairman of the Federal Reserve]. I wouldn’t use him to drive my car. These guys are dangerous. They’re not qualified in their own field.”

Note: Black swans were discovered in Australia. Before that, any reasonable person could assume the all-swans-are-white theory was unassailable. But the sight of just one black swan detonated that theory. Every theory we have about the human world and about the future is vulnerable to the black swan, the unexpected event. We sail in fragile vessels across a raging sea of uncertainty. According to Taleb, “The world we live in is vastly different from the world we think we live in.”

That is Nassim Nicholas Taleb for you. Not exactly the paragon of modesty but he is being hailed as the greatest philosopher of our time.

The following is an extract from an essay, THE FOURTH QUADRANT: A MAP OF THE LIMITS OF STATISTICS, he wrote for “The Edge”. I want you guys to read this article and put down in the comments section your précis of the same. It is a good exercise for the RC passages in CAT

The Dangers Of Bogus Math

I start with my old crusade against "quants" (people like me who do mathematical work in finance), economists, and bank risk managers, my prime perpetrators of iatrogenic risks (the healer killing the patient). Why iatrogenic risks? Because, not only have economists been unable to prove that their models work, but no one managed to prove that the use of a model that does not work is neutral, that it does not increase blind risk taking, hence the accumulation of hidden risks.

Figure 1 My classical metaphor: A Turkey is fed for a 1000 days—every days confirms to its statistical department that the human race cares about its welfare "with increased statistical significance". On the 1001st day, the turkey has a surprise.

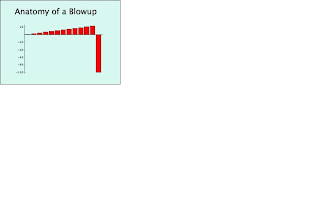

Figure 2 The graph above shows the fate of close to 1000 financial institutions (includes busts such as FNMA, Bear Stearns, Northern Rock, Lehman Brothers, etc.). The banking system (betting AGAINST rare events) just lost > 1 Trillion dollars (so far) on a single error, more than was ever earned in the history of banking. Yet bankers kept their previous bonuses and it looks like citizens have to foot the bills. And one Professor Ben Bernanke pronounced right before the blowup that we live in an era of stability and "great moderation" (he is now piloting a plane and we all are passengers on it).

Figure 3 The graph shows the daily variations a derivatives portfolio exposed to U.K. interest rates between 1988 and 2008. Close to 99% of the variations, over the span of 20 years, will be represented in 1 single day—the day the European Monetary System collapsed. As I show in the appendix, this is typical with ANY socio-economic variable (commodity prices, currencies, inflation numbers, GDP, company performance, etc. ). No known econometric statistical method can capture the probability of the event with any remotely acceptable accuracy (except, of course, in hindsight, and "on paper"). Also note that this applies to surges on electricity grids and all manner of modern-day phenomena.

Now let me tell you what worries me. Imagine that the Turkey can be the most powerful man in world economics, managing our economic fates. How? A then-Princeton economist called Ben Bernanke made a pronouncement in late 2004 about the "new moderation" in economic life: the world getting more and more stable—before becoming the Chairman of the Federal Reserve. Yet the system was getting riskier and riskier as we were turkey-style sitting on more and more barrels of dynamite—and Prof. Bernanke's predecessor the former Federal Reserve Chairman Alan Greenspan was systematically increasing the hidden risks in the system, making us all more vulnerable to blowups.

By the "narrative fallacy" the turkey economics department will always manage to state, before thanksgivings that "we are in a new era of safety", and back-it up with thorough and "rigorous" analysis. And Professor Bernanke indeed found plenty of economic explanations—what I call the narrative fallacy—with graphs, jargon, curves, the kind of facade-of-knowledge that you find in economics textbooks. (This is the find of glib, snake-oil facade of knowledge—even more dangerous because of the mathematics—that made me, before accepting the new position in NYU's engineering department, verify that there was not a single economist in the building. I have nothing against economists: you should let them entertain each others with their theories and elegant mathematics, and help keep college students inside buildings. But beware: they can be plain wrong, yet frame things in a way to make you feel stupid arguing with them. So make sure you do not give any of them risk-management responsibilities.)

The full article is present here:

http://www.edge.org/3rd_culture/taleb08/taleb08_index.html

Ciao

Gautam

Mathematicians and economists put theories based on assumptions. Every variable can not be included in the theories. There are certain events which may lead to burst of the economic system leading to chaos and high losses. These losses are recovered from common man who is the ultimate sufferer of the foolish steps.

ReplyDelete*** Prof. Bernanke is in contention for second term as a chief of Federal Reserve

http://link.ft.com/r/CTBPCC/EVHP7/MFVON/9BCV5/88Q2Y/MQ/h

As far as d synopsis of dis extract goes... The extract spks abt d occurance of a rare event(black swan) of a large magnitude n consequence in d financial world. The author asserts tht all d financial institutions r highly exposed 2 dangerous, risky black swan events n r vulnerable 2 losses beyond d prediction of mathematical models formed by dem!!!

ReplyDeleten when a black swan event occurs, d turkey economists dept always manage 2 state tht d situation is stable n back it up wid another set of stats n mathematical models n act as if d event is rational n had been expected (as done by Prof. Bernanke)!!!

P.S. Figures, though accurate, might b moulded n manipulated by selfish ppl 2 conceal d truth n present a distorted picture of facts 2 d public 2 meet der selfish motive!!! When skilled orators, writers, or politicians thru der forceful writings n speeches mislead public by quoting wrong statistical stmts/manipulating statistical data, public starts losing faith n belief in science of statistics, as d person unlike a statistician isn't in a position 2 distinguish bet valid n invalid conclusions frm statistical statement n analysis.

Stats neither proves or disapproves anything!!! It isn't d subject of statistics 2 b blamed but those ppl who twist numerical data n misuse them, either due 2 ignorance or deliberately fr personal selfish motives!!!

Ben Bernanke has been nominated for the second term.

ReplyDelete